Stabilization of Cash Flow

Stabilization of cash flows backed by a long-term lease agreement that stipulates a rent system which combines base rent and performance-linked rent, in principle, as well as by a solid management structure

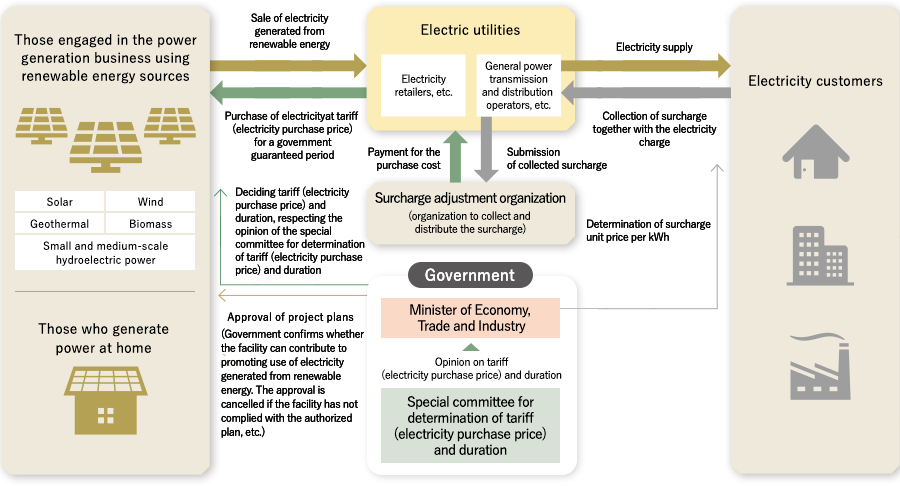

Overview of the Feed-In Tariff Scheme for Renewable Energy (FIT Scheme)

The FIT scheme was launched in July 2012 under the Act on Special Measures Concerning Procurement of Electricity from Renewable Energy Sources by Electricity Utilities in order to spread renewable energy. It obliges utilities to purchase electricity generated from renewable energy over a set period of time at an officially certified price of electricity (tariff). The FIT scheme allows power generation operators to project stable and continuous revenue from electricity sales and to schedule collection of the high cost of constructing renewable energy power generation facilities.

- Prepared by the Asset Management Company based on “Feed-In Tariff Scheme in Japan” (July 2012) by Agency for Natural Resources and Energy, the Ministry of Economy, Trade and Industry

Tariff, the officially certified price of electricity for the solar power generation facilities under the FIT scheme, has been lowered every year, reflecting the lowering construction cost due to technological innovation and market competition. Tariff for the solar power generation facilities with an output of 10 kW or more has been lowered from 40 yen (excluding tax) per 1 kWh in fiscal 2012 to 18 yen (excluding tax) per 1 kWh in fiscal 2018, and may continue to be lowered going forward. However, tariff and duration that have been fixed will not be changed, in principle, for any renewable energy power generation facility.

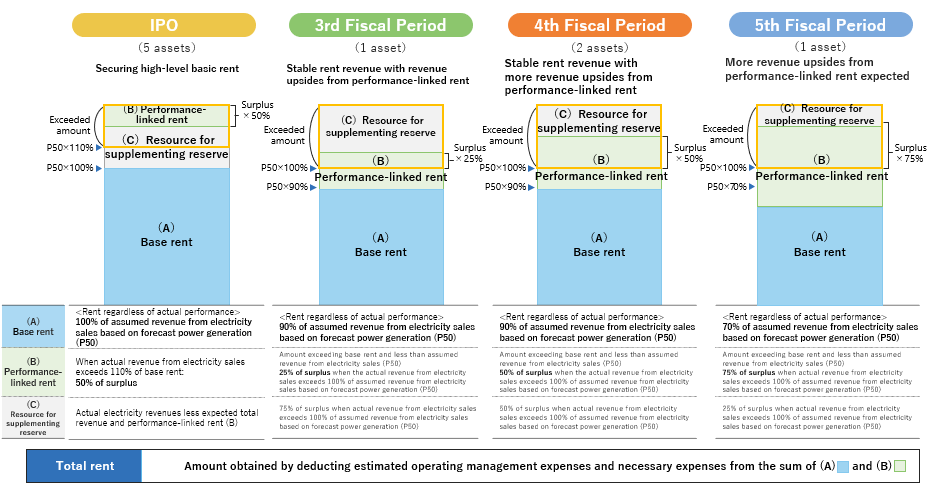

Rent Scheme of EII

●Setting up flexible rent schemes based on the facilities to maximize unitholder value

Reduction of risks of non-payment of rents due to bad weather and other risks, through a rent reserve account and additional contribution.

The Sponsor becomes a Japanese anonymous (tokumei kumiai) investor of the SPCs and makes the initial contribution to the SPCs. With respect to the renewable energy projects, the SPCs, as lessees, reserve a certain amount from the initial contribution into a rent reserve account.

EII reduces risk of non-payment of rents due to bad weather and other risks by a rent reserve account.

When actual electricity revenue exceeds the projected electricity revenue and excess electricity revenue is generated in a fiscal year, and the reserve in the rent reserve account is less than the requisite amount, the SPCs are required to maintain such reserve amount by means of, among other things, reserving excess electricity revenue until shortage is met.

In addition, in a case where the amount accumulated in the reserve account for rent income is not sufficient to pay the base rent, EII maintains that amounts by preparing a supplement scheme in which EII requires the silent partnership investors from the Power Generation Operator(SPC) to make an additional contribution up to the certain equivalent.

- Details of each asset acquired are provided in the Securities Registration Statement and the Annual Securities Report.