Renewable Energy Investment

Investment in renewable energy power generation facilities including solar power generation facilities, wind power generation facilities and hydroelectric power generation facilities

Initiatives to Expand the Introduction of Renewable Energy

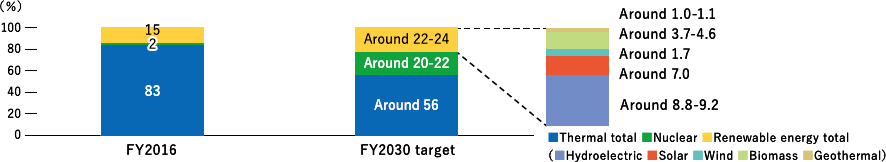

The Ministry of Economy, Trade and Industry announced “Long-term Energy Supply and Demand Outlook” in July 2015, drawing up an energy mix for FY2030 with an eye on safety, energy security, economic efficiency and environment, which are the basic perspectives for its energy policy.

Renewable energy, which is a domestically produced, low-carbon energy, will be introduced proactively and account for around 22% to 24% of the total power generation in FY2030. In addition, the cabinet approved the Fifth Strategic Energy Plan in July 2018 which states that it will proactively continue to promote turning renewable energy into the main power supply to achieve the energy mix for FY2030. Since the expansion of the introduction of renewable energy has been progressing globally as well, the government has taken initiatives to promote gradual reduction of power generation costs, improve grid constraints and develop the business environment.

● Increasing Ratio of Renewable Energy in the Power Source Composition

- Prepared by the Asset Management Company based on “Policy Issues in the Era of Mass Introduction of Renewable Energy and Principles of Next-Generation Electricity Networks” (December 18, 2017) and “The Fifth Strategic Energy Plan” (July 3, 2018) by Agency for Natural Resources and Energy, the Ministry of Economy, Trade and Industry

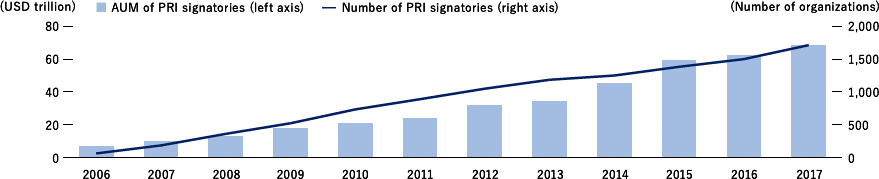

● Expansion of Assets Managed under ESG Investment Serving as a Tailwind for Renewable Energy Investment

“ESG investment” refers to the investment method in which investors make investment by selecting companies

with high marks for ESG factors, which are non-financial information.

In Japan, the ratio of ESG investment in assets under management is still low, but is expected to expand going

forward as the Government Pension Investment Fund (GPIF) started investment linked to ESG index in 2017.

EII believes that the expansion of ESG investment will serve as one of driving forces for the development of

renewable energy power generation business that contributes to the global environment.

● Number of Signatories to the UN’s Principles for Responsible Investment (PRI) and the Total Amount of Assets Managed by the Signatories

- Prepared by the Asset Management Company based on the website of the UN’s Principles for Responsible Investment (PRI) (https://www.unpri.org/) (as of May 1, 2018).

- “PRI signatories” refers to institutional investors which have signed the PRI.